Energy Storage Outlook

Stay up-to-date with the latest trends, analysis, and insights in the battery energy storage industry in the Americas.

BESS USA vs LATAM

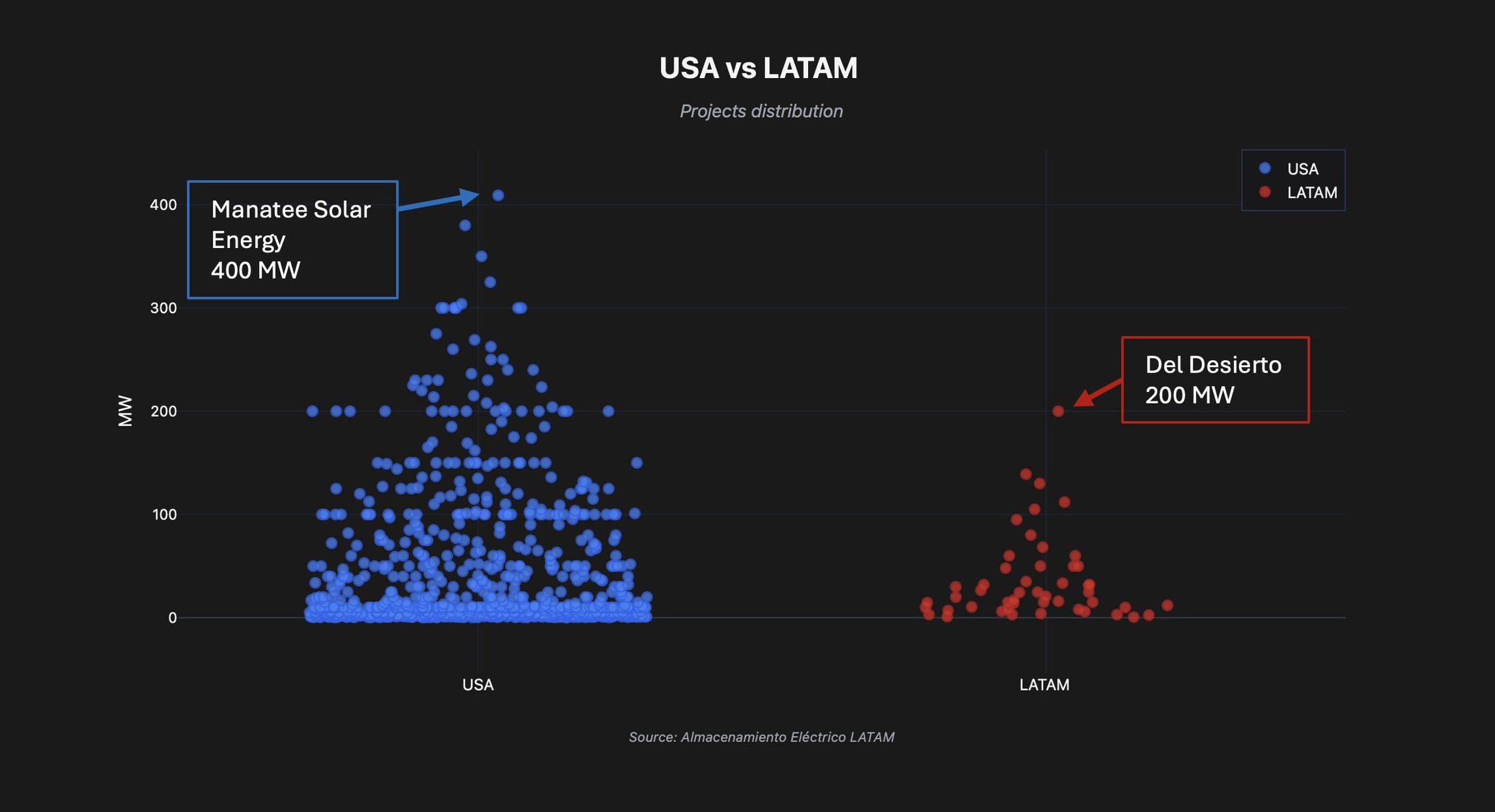

The distribution of BESS projects in Latin America and the United States tells a very interesting story.

While the United States is concentrating on megaprojects, Latin America is advancing rapidly, catching up with the big players with new all-time highs.

In the United States, there are 51 projects with a capacity exceeding 200 MW, representing 33% of the total installed capacity. Manatee Solar Energy (of Florida Power & Light) leads the list with 409 MW.

In Latin America, the scenario is emerging but with a clear direction. Although for now only Atlas Renewable Energy's Del Desierto project reaches 200 MW, there are already larger projects in the planning phase, such as BESS Pueblo Hundido (405 MW), which reaffirms the region's potential.

What's next? By 2026, we expect double-digit growth in the historical capacity of many countries in the region. This dynamism will be driven primarily by:

1) The accumulated expertise of the local industry

2) Advances in the regulatory framework this year (and in the coming years)

Review BESS's projects in the Americas in detail with the LATAM Electrical Storage Pro Plan.

BESS LATAM

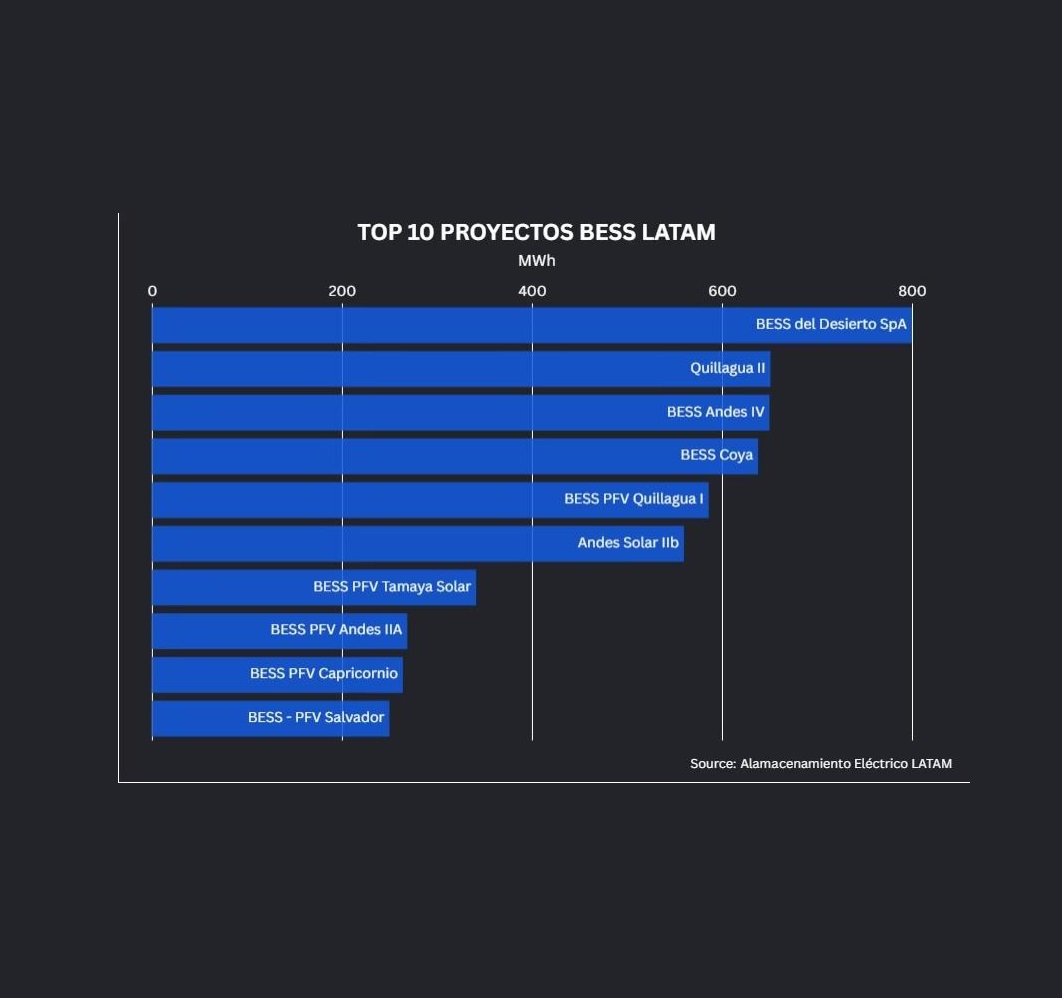

The 10 largest BESS projects in LATAM

Latin America has had a record year in terms of deployed electrical storage capacity for grid use.

In September 2025, the largest BESS project in the region to date began operations, and others with even greater capacity are currently under development.

However, what are the biggest projects today?

Let's take a closer look:

10. BESS - PFV Salvador (50 MW, 250 MWh) Company: Innergex With an investment of USD $75 million and a discharge capacity of 5 hours, this project located in the Atacama desert stores energy paired with a solar power plant.

9. BESS PFV Capricornio (48 MW, 264.2 MWh) Company: ENGIE Chile Located in Antofagasta, this system supports the dispatch of renewable energy and improves the operational flexibility of northern Chile.

8. BESS PFV Andes IIA (80 MW, 268.8 MWh) Company: AES Andes Combines solar generation and storage, also located in Antofagasta, Chile.

7. BESS PFV Tamaya Solar (68 MW, 341 MWh) Company: ENGIE Chile Near Tocopilla, and the second largest BESS plant of Engie in Chile.

6. Andes Solar IIb (112 MW, 560 MWh) Company: AES Andes. Key part of the Andes Solar complex in Antofagasta. Combines photovoltaic generation with large-scale storage.

5. BESS PFV Quillagua I (95 MW, 586 MWh) Company: ContourGlobal Located in María Elena, this project strengthens the continuity of solar supply and lays the foundations for BESS development in the northern zone.

4. La Coya (158 MW, 638 MWh) Company: ENGIE Chile Integrated into the Coya solar park, in Antofagasta, this system allows the storage of energy generated during the day for use during peak hours.

3. BESS - Andes IV (130 MW, 650 MWh) Company: AES Andes The BESS system of AES Andes, also in Antofagasta, is paired with a solar plant.

2. Quillagua II (105 MW, 651 MWh) Company: ContourGlobal Second phase of the Quillagua project, with entry into operation in September 2025. Together with Quillagua I, it reaches 1,219 MWh, so, together both projects are considered the largest BESS of its kind in LATAM.

1. BESS del Desierto SpA (200 MW, 800 MWh) Empresa: Atlas Renewable Energy El BESS stand-alone más grande de América Latina, ubicado en Antofagasta. Inaugurado en abril y completamente operativo desde septiembre, representa un paso hacia adelante en los proyectos BESS en la región de latinoamerica.

The common denominator of all these projects? The answer: Chile.

With more than 1.4 GWh currently operating, Chile is comfortably positioned as the leader in Latin America in electrical storage.

Policy & Regulation

Mexico's National Energy Commission (CNE) issues terms for granting electricity storage permits

On October 23, the CNE issued new General Administrative Provisions on permits for Electrical Storage Systems (SAEs).

Among the determinations regarding requirements and validity periods for permits for market entities, these are the key points to highlight in the new provision:

- Self-consumption: Simplified procedures for plants ≥0.7 MW (isolated/interconnected), valid for up to 20 years. Social impact exemption for <20 MW isolated plants.

- Wholesale Market: Mixed schemes with CFE (≥54% participation) up to 30 years; independent, 25 years. Includes long-term production exclusively for CFE.

- Storage: New permits valid for 20 years, requiring impact studies from CENACE.

- Modifications/Migrations: Facilitates updates to legacy permissions (LSPEE/LIE), transfers and mergers, with clear requirements in technical/financial capacity.

- Rapid evaluation: 60 business days max., with prevention of omissions and use of digital formats.

Current storage in Argentina

With defined rules focused on improving the adoption of Electrical Storage Systems (ESS), the electricity sector will be able to transition faster to a clean, efficient and resilient system.

Consult the official text here: DOF – Diario Ofiacial de la Federacion https://dof.gob.mx/nota_detalle.php?codigo=5770667&fecha=23/10/2025#gsc.tab=0

Industry Insights

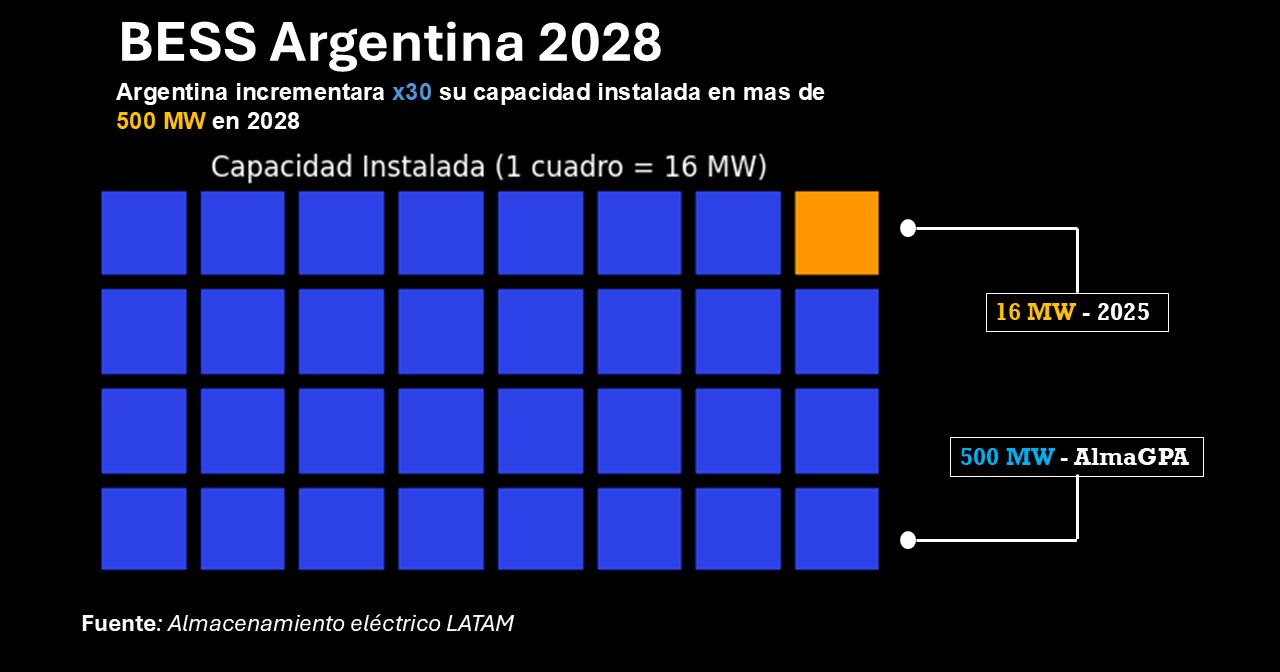

Argentina 🇦🇷 has one of the most ambitious BESS goals in all of LATAM.

In February 2025, the Ministry of Energy launched a tender for electrical energy storage with the goal of achieving a 500 MW installation by 2028.

Known as AlmaGBA (Energy Storage for Greater Buenos Aires), during the application period, a bid of 1,347 MW was received, exceeding the initial offer by approximately 170%.

What are the main characteristics of AlmaGBA?

🔋 Capacity tendered: 500 MW with 4 hours of storage.

🗓️ Maximum commissioning date: December 31, 2028.

💵 Estimated investment: US$500 million.

27 projects totaling 1,347 MW were submitted (significantly exceeding the 500 MW target). Official awards are expected in August 2025.

Current Storage in Argentina

Argentina currently has a BESS electrical storage capacity of 10 MWh for grid use. This capacity is distributed across two different plants:

- San Nicolás (AES Argentina)

- San Juan (360Energy)

👷Strategic Importance:

The AlmaGBA tender marks a milestone in Argentina's energy transition. Its objective is to reduce power outages, support renewable energy, and improve the flexibility of the electrical system.

🎯Looking to the Future:

Policymakers in Latin America see electrical storage as a key solution for attracting greater clean, reliable, and efficient energy capacity, and Argentina is no exception.

Market Analysis

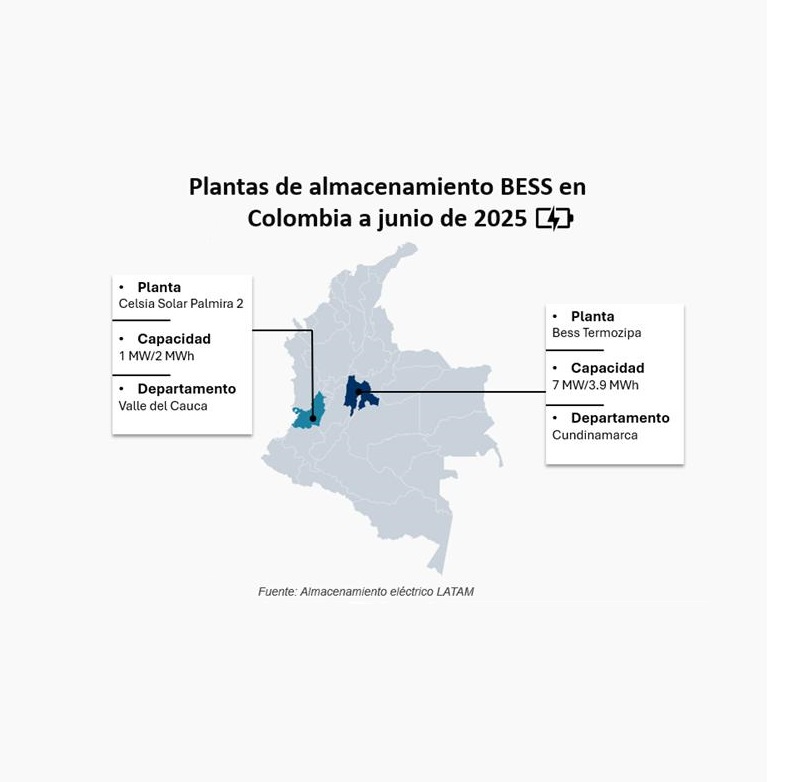

Colombia strengthens its energy transition with Battery Storage System (BESS)

Currently, two utility-use systems are already operational on the country's network:

Termozipa (2021): Built by ENEL in Cundinamarca, this system has a capacity of 7 MW / 3.9 MWh and has been operating since 2021.

Celsia Solar Palmira 2 (2024): Located in the Cauca Valley, this 1 MW / 2 MWh project is coupled to a photovoltaic plant and began operating this year.

⚡In addition, Erco Energy's project in La Martina, with a capacity of 6.9 MWh, stands out as an initiative in the development phase that promises to further strengthen the storage infrastructure.

⚖️ The recognition of BESS by the Energy and Gas Regulatory Commission (CREG) in the regulatory framework (Resolution 098), added to the participation of the IDB in some of these projects, underlines the growing interest and support from public policy.

🌎 This year is crucial for the future of BESS projects in Colombia. Law 2099 sets a goal of reaching 6 GW of renewable energy, such as solar and wind, by 2026, which implies a significant boost for electrical storage.

The big bet on electrical storage in LATAM is getting stronger every day.

Growth in Chile

Chile has the potential! 🔋

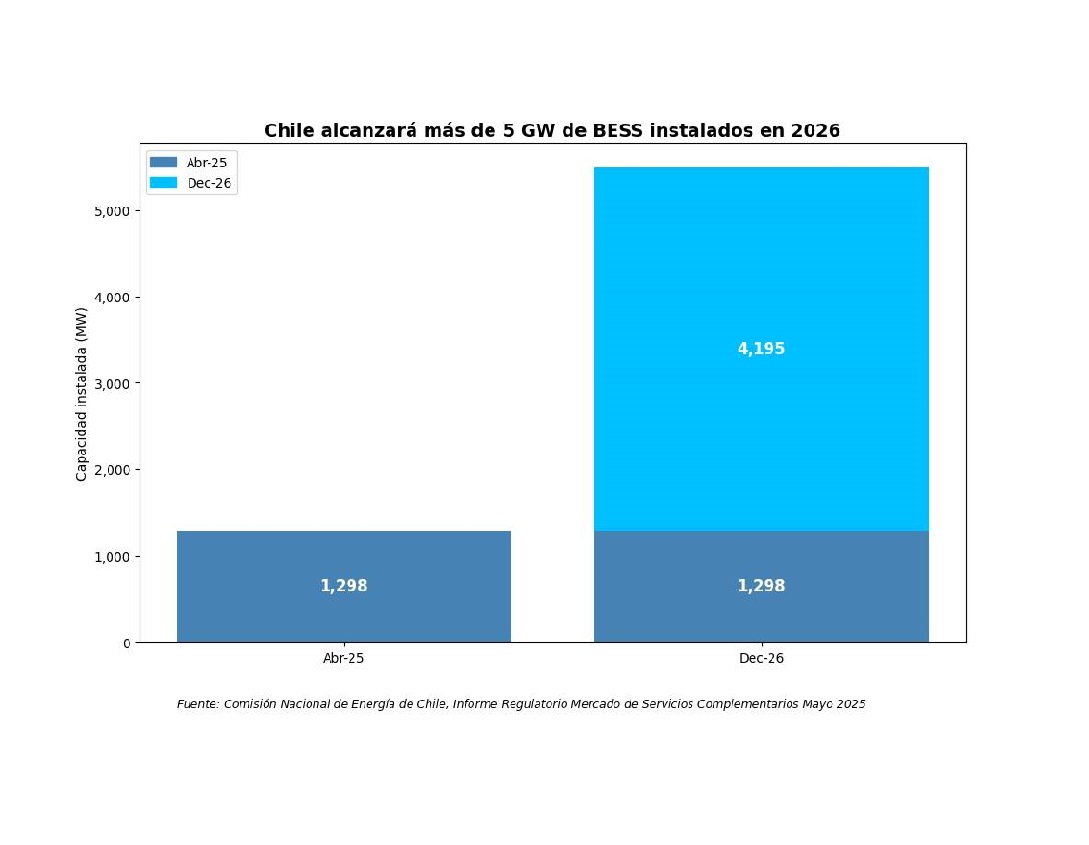

With 1.3 GW of electrical storage capacity, Chile is positioned as the leading country in Latin America🚀, and it seems unlikely to relinquish that position anytime soon.

Data from the National Electricity Coordinator (CEN) shows that projects under construction and commissioned will increase operational capacity to 5.5 GW by December 2026, representing a 323% growth in a 20-month period 📈.

Currently, some of Chile's largest projects are: ☀️

BESS del Desierto: 800 MWh / 200 MW ☀️

BESS Andes IV: 650 MWh / 130 MW 🌬️

Quillagua: 586 MWh / 95 MW 💡

Currently, La Arena BESS is the largest project under construction, with 1,100 MWh / 200 MW of capacity expected to be interconnected in December 2025.

Why is Chile positioned as the leading country in Latin America in adopting electrical storage systems? ⚖️

💼 Timely Regulation: Chile was a pioneer in establishing clear market rules in 2022 for electrical storage plants to operate with energy arbitrage services and ancillary services. A regulatory framework that drives investment!

♻️ High Renewable Energy Penetration: In 2024, wind and solar energy reached a combined installed capacity of 11 GW, generating approximately 33% of the country's total electricity. This growing share of intermittent sources creates a strategic need to address hourly supply and demand fluctuations with flexible solutions such as Energy Management Systems (EMS).

Chile's energy future is bright! An example to follow in the global energy transition! ✨

Policy & Regulation

Energy storage systems are gaining ground in Mexico’s power market

Electric Storage Systems (ESS) are gaining ground in the Mexican electricity market 🚀🔋. As of June 2025, there are 206 MWh and 95 MW of usable capacity 📈, mainly distributed across the states of Baja California Sur (117 MWh), Quintana Roo (25 MWh), and Sonora (24 MWh).

What are the largest projects currently underway in Mexico? The main ones are:

La Toba (80 MWh) ☀️

Plan Sonora (24 MWh) 💡

The Mexican market is at a turning point where the combination of regulation, grid conditions, and costs makes ESS an attractive market in Mexico 🌍.

📜 Regulation

RES/113/2024 mandates that new intermittent renewable energy plant capacity must include at least 30% additional electrical storage capacity.

♻️ Supply Chains

Lazard's 2025 LCOE+ shows a reduction in the average Levelized Cost of Energy Storage (LCOS) of $233/MWh*, representing a 21% year-over-year decrease. This is due to a rebound in BESS manufacturing capacity and technological advancements in LFP batteries.

⚡The Future

The significant investment in BESS is progressively expanding towards peak shaving, more so in the National Interconnected System (SIN) than in isolated regions. With progress in regulation and price reductions, the future looks bright for the Mexican market.

Case Study

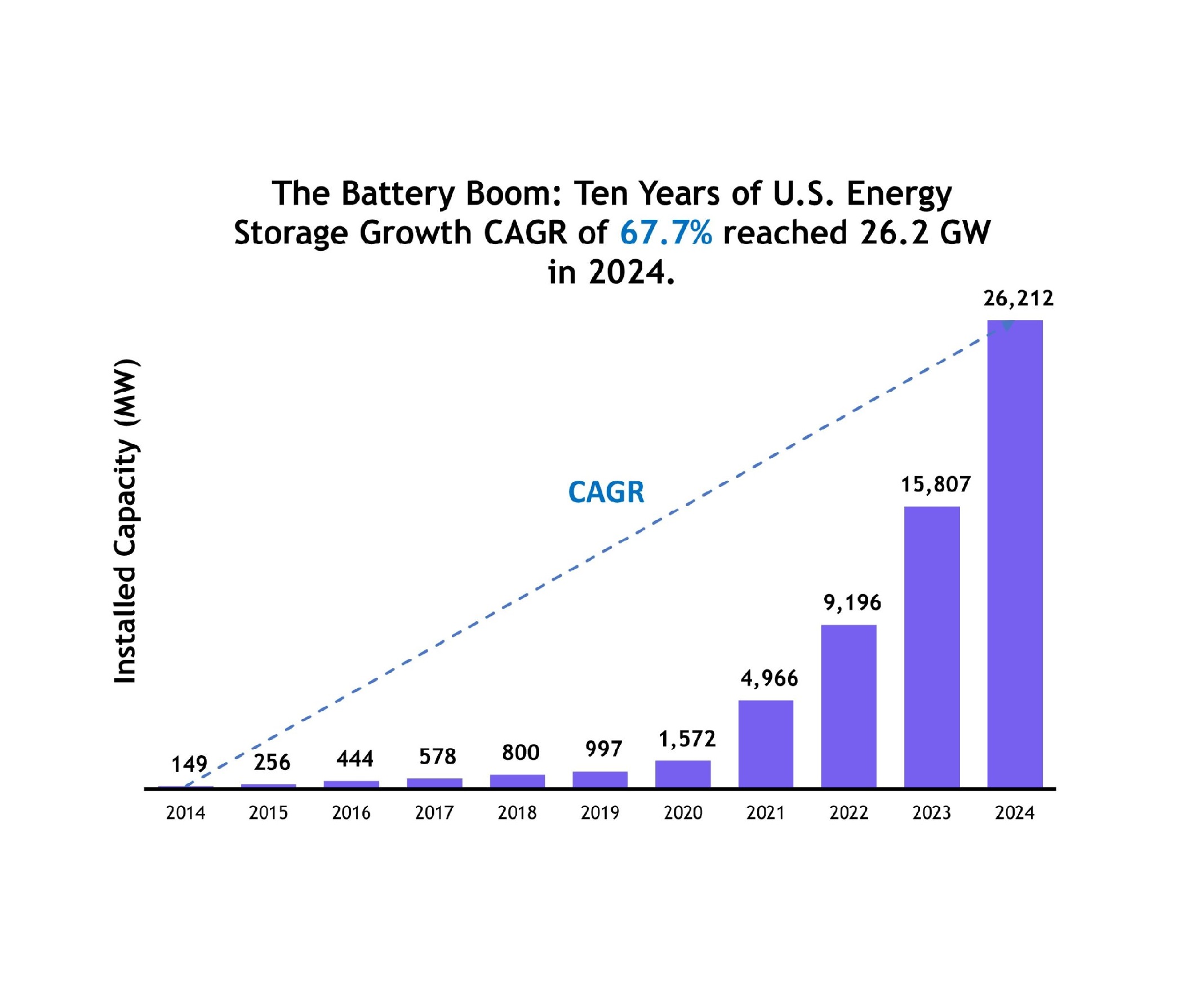

The rise of batteries: 10 years of growth in US energy storage.

Over the past decade, the U.S. energy storage sector has gone from a niche to a necessity. In 2014, total battery storage capacity was only a few hundred megawatts. By 2024, we had surpassed 26,000 MW—an increase of more than 50 times.

The chart below (source: EIA 860-M) shows how storage has grown, especially since 2020, driven by: falling battery costs, clean energy mandates and tax incentives, grid modernization, and the integration of renewable energy.

This increase is not just a milestone, but a signal. Energy storage is no longer an afterthought; it is critical to the clean energy transition.

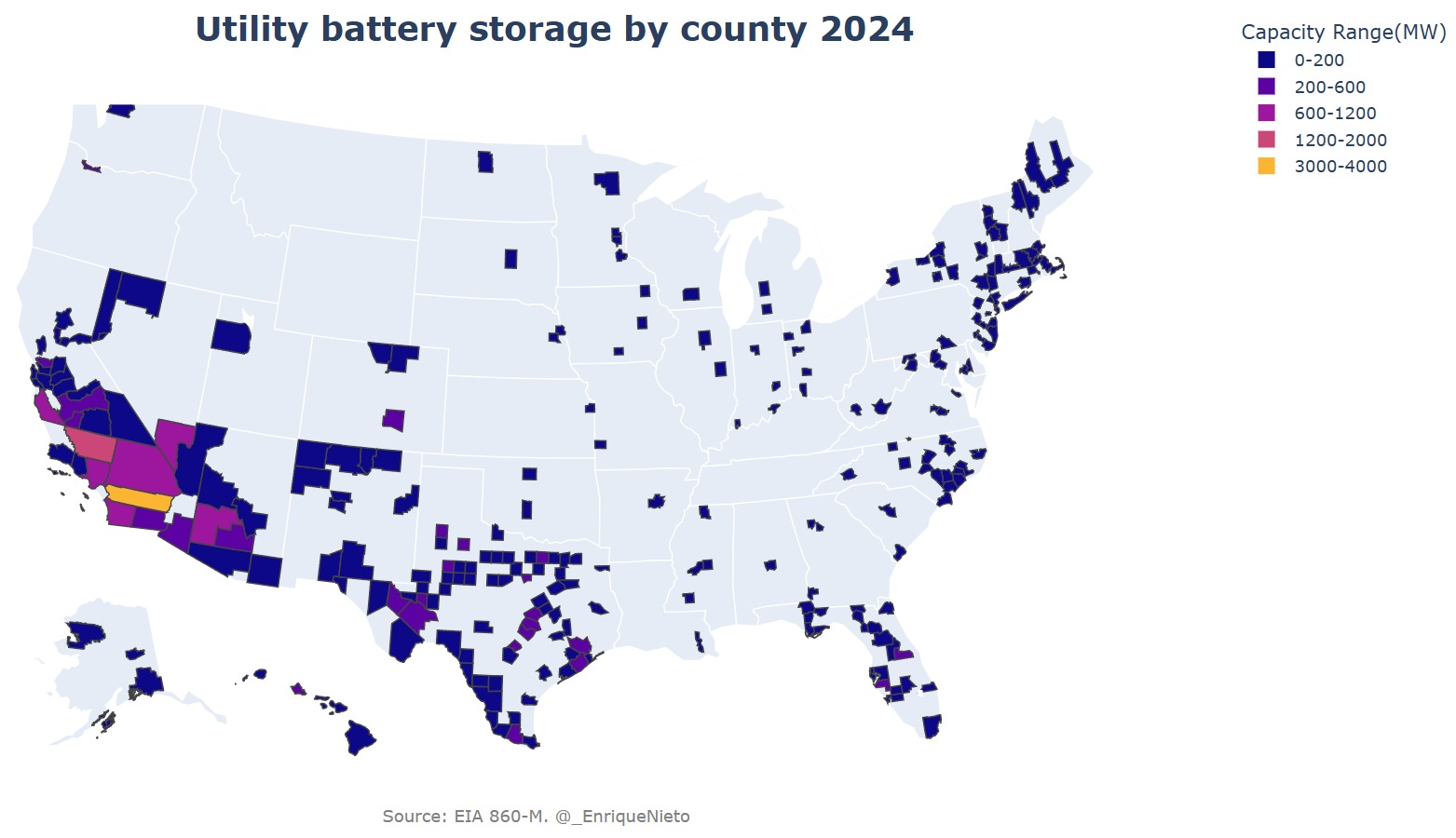

BESS USA

Battery storage capacity in California is booming

With over 11 GW already installed, the state is poised for explosive growth with nearly 4 GW of new projects planned for this year. Riverside County alone has 3.5 GW installed, highlighting the rapid expansion. Welcome to the Decade of Energy Storage.